The activity of “acquisitions and mergers” or “M&A” has long become one of the solutions to restructure enterprises to improve efficiency. M&A is becoming a global investment trend and has grown strongly in Vietnam recently, especially when the Trans-Pacific Partnership (TPP) Agreement was signed. Currently, the State has issued many different legal documents to regulate this activity such as the Law on Enterprises, the Law on Investment, the Law on Competition,… and related guiding documents.

With many years of operation in the field of business consulting, especially M&A activities, LawPlus would like to send to customers the basic regulations on the above activities for customers to reference.

>>> NEW REGULATIONS ON THE ENTERPRISE REGISTRATION

Table of Contents/Mục lục

I. OVERVIEW OF MERGER AND ACQUISITION

1.1. What is the concept of M&A?

Form of merger or acquisition of part or the whole enterprise. In English, this activity is abbreviated as M&A (Merger & Acquisition), which means merger and acquisition. MERGER AND ACQUISITION ENTERPRISE

According to Clause 4 of the Competition Law 2018, the acquisition is the act of an enterprise directly or indirectly purchasing all or part of the contributed capital or assets of another enterprise which is sufficient to control and dominate the enterprise or a line or line of business of the acquired enterprise.

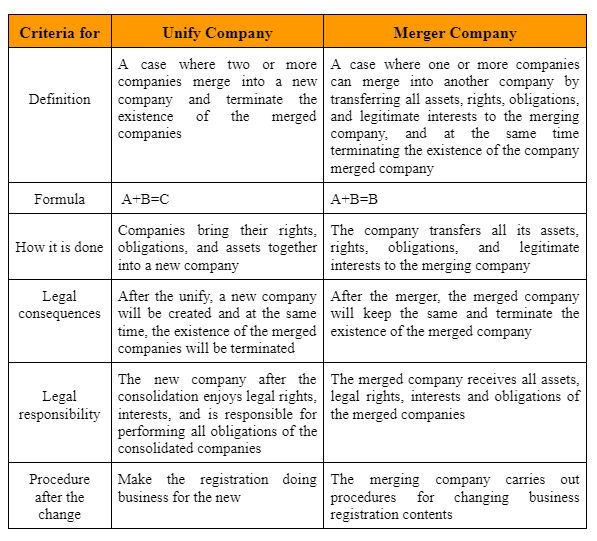

A merger is a case where one or several companies can merge into another company by transferring all assets, rights, obligations, and legitimate interests to the merging company, and at the same time terminate the existence of the merged company.

There is also the concept of Enterprise Consolidation, according to Clause 1, Article 200 of the Enterprise Law 2020, a merger is a case where two or more companies merge into a new company and terminate the existence of the affected companies unify.

1.2. Some legal provisions on M&A

M&A activities are regulated by our State in various specialized legal documents such as Enterprise Law, Competition Law, Securities Law, and Investment Law. ..specifically as follows: MERGER AND ACQUISITION ENTERPRISE

1.2.1. According to the Enterprise Law

The Enterprise Law provides the concept and sequence of procedures for mergers, consolidation, and enterprises. The Enterprise Law 2020 also considers corporate M&A as a form of business reorganization stemming from the needs of the business itself. Although there is no clear definition of corporate M&A, the Enterprise Law has specific provisions on M&A for each type of enterprise, specifically MERGER AND CQUISITION ENTERPRISAE

Chapter 2

Article 17 (Right to establish, contribute capital, purchase of shares, purchase of contributed capital, and management of the enterprise) specifies that organizations and individuals have the right to contribute capital, purchase shares, and purchase capital contributions to joint-stock companies, limited liability companies, and partnerships, except for the following cases: State agencies and units of the people’s armed forces use state assets to contribute capital to enterprises for their profit; Subjects are not allowed to contribute capital to enterprises by the law on cadres and civil servants.

Chapter 3

For limited companies, Article 51 (Repurchase of contributed capital) and Article 52 (Transfer of contributed capital) specifically provide for several issues related to the transfer of members’ capital contributions. Co., Ltd.

Chapter 5

For joint-stock companies, Article 126 (Selling shares) and Article 127 (Transferring shares) indicate that the Board of Directors decides the time, method, and price of selling shares. The selling price of shares must not be lower than the market price at the time of offering, or the value recorded in the books of the shares at the latest time, except in special cases. Article 127 (Assignment of shares) also stipulates that shares of a joint-stock enterprise are freely transferable. The transfer is done by contract in the usual way or through transactions on the stock market (stock market).

Chapter 9

Also specifies the number of issues such as division of enterprises (Article 198), and separation of enterprises. Enterprise (Article 199), consolidation (Article 200), procedures, dossiers, and order of registration of the merging enterprise (Article 201).

The Enterprise Law 2020 emphasizes that the consolidating company automatically all the lawful rights, obligations, and interests of the consolidated companies under the company consolidation contract and the merging company automatically inherits. inherit all rights, obligations, and legitimate interests of the merged company under the contract (Articles 200 and 201).

Article 200. Consolidation of companies

Two or more companies (consolidating companies) may be consolidated into a new company (consolidated company), after which the consolidating companies shall cease to exist.

-

Consolidation procedures:

a) The consolidating companies shall prepare the consolidation contract and charter of the consolidated company. The contract shall contain the names and addresses of the consolidating companies; the name and address of the consolidated company; procedures and conditions for consolidation; employment plan; deadline and conditions for the transfer of assets, shares/stakes, and bonds of the consolidating companies to the consolidated company; consolidation time;

b) The members, owners, or shareholders of the consolidating companies shall ratify the consolidation contract, the consolidated company’s charter, elect or designate the President of the Board of Members, President of the company, Board of Directors, the Director/General Director of the consolidated company and apply for registration of the consolidated company by this Law. The consolidation contract shall be sent to the creditors and employees within 15 days from the day on which it is ratified.

Article 201. Merger of companies

….

-

Merger procedures:

- a) The acquiring company and acquired company shall prepare the acquisition contract and draft the charter of the acquiring company. The contract shall contain the name and address of the acquiring company; name and address of the acquired company; procedures and conditions for acquisition; employment plan; method, procedures, deadline, and conditions for the transfer of assets, shares/stakes, bonds of the acquired company to the acquiring company; acquisition time;

- b) The members, owners, or shareholders of the companies shall ratify the acquisition contract and the acquiring company’s charter and apply for registration of the acquiring company by this Law. The acquisition contract shall be sent to the creditors and employees within 15 days from the day on which it is ratified;

1.2.2. According to Investment Law

The Investment Law 2020 takes effect from January 1st, 2021. This Law recognizes two forms of M&A, including merger and acquisition of companies. Mergers and acquisitions are considered forms of direct investment. The acquisition of a company can be done in the form of a partial or complete acquisition of the business or branch. Accordingly, investors have the right to contribute capital, purchase shares, and contribute capital to economic organizations (Article 24); Foreign investors can invest in the form of capital contribution, purchase of shares, or capital contribution to economic organizations (Articles 25 and 26).

Article 24. Investment in the form of capital contribution, share purchase, purchase of capital contributions

- Investors have the right to contribute capital, purchase shares, or purchase capital contributions from economic organizations.

- Foreign investors’ capital contribution, share purchase, or capital contribution purchase from economic organizations must satisfy the following regulations and conditions:

a) Market access conditions for foreign investors in addition to the provisions of Article 9 of this Law;

b) Ensuring national defense and security by this Law; MERGER AND ACQUISITION ENTERPRISE

c) Regulations of the land law on conditions for receiving land use rights, conditions for using land in islands, communes, wards, border towns, communes, wards, and coastal townships.”

Article 25. Forms of capital contribution, share purchase, purchase of contributed capital portions

1. Investors may contribute capital to economic organizations in the following forms: MERGER AND ACQUISITION ENTERPRISE

a) Purchase of shares issued for the first time or issued shares. more of the joint stock company;

b) Contributing capital to a limited liability company or a partnership;

c) Contributing capital to other economic organizations other than those specified at Points a and b of this Clause.

2. Investors purchase shares or capital contributions from economic organizations in the following forms:

a) Purchase shares of a joint-stock company from the company or shareholders;

b) Purchase the capital contribution of a member of a limited liability company to become a member of a limited liability company;

c) Purchase capital contributions of capital contributors in a partnership to become a capital contributor of the partnership;

d) Purchase of capital contributions from members of other economic organizations other than those specified at Points a, b, and c of this Clause.”

Article 26. Investment procedures in the form of capital contribution, share purchase, or capital contribution

-

Investors contributing capital, buying shares, or purchasing capital contributions from economic organizations must satisfy the conditions and practice implementing procedures for changing members and shareholders according to the provisions of law corresponding to each type of economic organization.

-

Foreign investors shall carry out procedures for registration of capital contribution, share purchase, or capital contribution of economic organizations before changing members or shareholders if they fall into one of the following cases:

a) The contribution of capital, purchase of shares, and purchase of contributed capital increases the foreign investors’ ownership rate in economic organizations engaged in business lines and trades with conditional market access for foreign investors;

b) The contribution of capital, purchase of shares, and purchase of contributed capital lead to the fact that foreign investors and economic organizations specified at Points a, b, and c, Clause 1, Article 23 of this Law hold more than 50% of the capital. the charter of the economic organization in the following cases: increasing the rate of ownership of the charter capital of foreign investors from less than or equal to 50% to over 50%; increasing the rate of ownership of charter capital of foreign investors when foreign investors already own more than 50% of charter capital in economic organizations; MERGER AND ACQUISITION ENTERPRISE

c) Foreign investors contribute capital, purchase shares or purchase capital contributions from economic organizations with land use right certificates in islands and border communes, wards, and townships; coastal communes, wards, and towns; other areas affecting national defense and security.

3. Investors who do not fall into the cases specified in Clause 2 of this Article shall carry out procedures for changing shareholders or members by relevant laws when contributing capital, buying shares, or purchasing capital contributions of the organization. economic organization. If there is a need to register the capital contribution, share purchase, or purchase of capital contributions from economic organizations, the investor shall comply with the provisions of Clause 2 of this Article.

Clause 3, Article 47, Investment Law 2020

About mergers and acquisitions transactions that harm or threaten to harm national defense and security in other cases, the Government has taken steps to The final block is Clause 3, Article 47 of the Law on Investment 2020: MERGER AND ACQUISITION ENTERPRISE

“3. The Prime Minister shall decide to suspend or stop part of the operation of an investment project in case the implementation of the investment project harms or threatens to cause harm to national defense and security at the request of the Prime Minister. Ministry of Planning and Investment.”

Accordingly, the Prime Minister is entitled to stop the operation of an investment project in case the implementation of the investment project harms or threatens to cause harm to national defense and security. country at the request of the Ministry of Planning and Investment.

1.2.3. According to the Competition Law

According to Clauses 2, 3, and 4, Article 29 of the 2018 Competition Law:

The merger of an enterprise is the transfer of all assets, rights, obligations, and legitimate interests of the enterprise by one or several enterprises. transfer to another enterprise, and at the same time terminate the business operation or existence of the merged enterprise.

Enterprise consolidation is when two or more enterprises transfer all of their assets, rights, obligations, and legitimate interests to form a new enterprise, and at the same time terminate business operations or the existence of other enterprises. consolidated businesses.

Acquisition of an enterprise means the purchase of all or part of the contributed capital or assets of another enterprise by an enterprise directly or indirectly, sufficient to control and dominate the acquired enterprise or industry. MERGER AND ACQUISITION ENTERPRISE

According to the Competition Law, the merger of enterprises, consolidation of enterprises, acquisition of enterprises, and joint ventures between enterprises are acts of economic concentration. Therefore, the merger, consolidation, or acquisition of enterprises is prohibited in case this merger, consolidation, or acquisition creates a combined market share of enterprises participating in the economic concentration, causing impacts or potentially significantly restricting competition in the Vietnamese market (Article 30).

1.2.4. According to the Securities Law

According to Clause 1, Article 93 of the Securities Law 2019, the reorganization of securities companies and securities investment fund management companies must be approved by the State Securities Commission before implementation.

1.2.5. According to the Law on Credit Institutions

According to Clause 1, Article 153 of the Law on Credit Institutions 2010, credit institutions may be reorganized in the form of division, separation, consolidation, merger, or legal transformation after approval in writing by the State Bank. MERGER AND ACQUISITION ENTERPRISE

1.2.6. According to Vietnam’s international commitments

Vietnam has signed and joined many investment-related or investment-related agreements such as investment agreements/chapters within the framework of the FTA; other commitments related to investment such as the Agreement on trade-related investment measures of the World Trade Organization (WTO), agreements on services in the WTO and FTAs, membership agreements establishment of a multilateral investment guarantee organization, the 1958 New York Convention on the recognition and enforcement of foreign arbitral awards…

In general, Vietnam’s agreements and commitments related to M&A activities can be present in the form of foreign investors’ share ownership ratio in Vietnamese enterprises or expressed in the form of a commitment to allow foreign investors to have a commercial presence and penetration in industries and fields. investment in Vietnam.

II. BENEFITS FROM BUSINESS MERGER AND ACQUISITION

2.1. Benefits from mergers and acquisitions

M&A activities bring a lot of benefits to businesses after implementation. Among them, the outstanding benefits are as follows:

Firstly, M&A contributes to improving the financial status of the business.

One of the main benefits that M&A activities bring is a significant improvement in corporate finance. Accordingly, after the merger, the new enterprise will have a strong financial resource. Thereby contributing to increasing competitiveness with other competitors in the market.

Secondly, M&A contributes to market expansion and business efficiency.

It is common for a business to make sales more efficiently than a business that specializes in marketing. Managers will create a link between the two businesses by sending the best salespeople and assigning tasks to the best marketing managers. Therefore, it creates the best coordination, bringing high efficiency to work.

Third, M&A helps improve technology – technical capabilities.

Similar to the benefits of market expansion, businesses after implementing M&A will have close coordination with the past. Thereby, businesses can take advantage of each other’s technology or techniques to create a competitive advantage. In addition, abundant capital is also one of the favorable conditions for them to equip modern technologies for business.

Fourth, M&A contributes to diversifying products and services for businesses.

When performing M&A, companies also acquire other companies with complementary products and services to diversify their products and services. By increasing the selection of goods and services a company offers to exist, consumer customers, and managers can generate more revenue for their company. MERGER AND ACQUISITION ENTERPRISE

2.2. Famous M&A deals in Vietnam

M&A is a very exciting activity in the Vietnamese market thanks to the benefits and influence it brings. Up to now, there have been many large M&A deals in Vietnam, thereby confirming the importance of this activity. Among them, can be mentioned the M&A agreement between ThaiBev and the Saigon Beer – Alcohol – Beverage Corporation (SABECO) or the M&A deal between Vingroup and SK Group in 2019.

The combination between ThaiBev and Sabeco is considered the largest M&A deal in the Asian beer industry with a total value of up to $4.8 billion. Accordingly, ThaiBev’s acquisition of a 53.59% stake in Sabeco has partly dominated Vietnam’s beverage market, and at the same time brought a huge source of revenue for this business. It can be seen that ThaiBev and Sabeco are two enterprises holding a large market share in the other beverage, wine, and beer markets of Thailand and Vietnam. MERGER AND ACQUISITION ENTERPRISE

Besides, the signing of a strategic cooperation agreement between SK Group and Vingroup is considered to be the deal with the highest transaction value in the market in 2019. Accordingly, SK Group has invested to buy back shares. part of Vingroup to enter the Vietnamese market. This acquisition has made SK Group the third largest .shareholder of Vingroup, thereby bringing great revenue as well as many .future cooperation opportunities for the two groups.

III. PROCESS OF ACQUISITION, MERGER

When deciding to carry out M&A activities, businesses often go through the following stages:

Step 1: Develop a strategy and identify the target company/asset

This is one of the most important steps in a merger. Before entering the M&A process, business leaders will need to build .for their business a clear strategy, what will be achieved from this M&A deal, and these potential goals can.be geolocation, profit, and customer file. Managers will base on potential targets from the strategy .development step, evaluate each given criterion, and then select potential targets from the established list.

The parties will provide good criteria as well as more information to help find the most potential target that is most suitable for the M&A deal.

Step 2: Proceed to negotiation between the Seller and the Buyer

This process takes place after going through the analysis the potential. To come up with several valuation models of the company as the target of mergers and acquisitions. Initial negotiations make a reasonable offer, and once .presented, the two companies can proceed to negotiate more detailed terms.

Step 3: NDA (non-disclosure agreement) / LOI (Letter of Intent)

When signing non-confidentiality agreements, it is the time .when the parties in the transaction will give each other the necessary information .financial, and security of each business.

Step 4: Outline the transaction structure

The parties will base themselves on each other’s requirements/desires. to jointly outline the steps to carry out the relevant transaction. Based on these outlines, the parties will get an overall picture/view of the transaction.

Step 5: Start Detailed Appraisal

This is a very important step, In this appraisal step the parties can appraise on:

Legal: Establishment and operation records; Regarding capital and owners; Regarding personnel and organizational .structure; Regarding labor; Regarding the transaction contract; Tax declaration, accounting; Regarding property….

Finance: Accounting policies; Revenue, expenses, profit; Tax; Pension policy; Financial plans….

Trade: SWOT analysis (Strengths – weaknesses. – Opportunities – Threats): Strengths – Weaknesses – Opportunities – Threats; Analysis of KPCs (Key Purchase Criteria): Criteria of customers when choosing company products; Analysis of CSFs (Critical Success Factors): CSFs are what. a business must have to accomplish its goals and strategies; Predictive Analytics (Forecast): Gives a clear view of the target company’s perspective and its likelihood of success. Compare the forecasted growth rate of the market and the forecasted speed of enterprises….

The appraisal will help confirm or adjust the value of the target company before signing the sale contract.

Step 6: Finalizing the transaction structure

The parties will base the results of the appraisal. the process to negotiate and discuss the price, method, and rate of the transaction.

Step 7: Drafting the contract and negotiating

If the parties do not have conflicting opinions, then .after the process of discussion and re-evaluation, the execution of the sale and purchase contract is almost the last step. The two parties will make the final decision on the purchase .and sale agreement whether to buy shares or buy assets.

This is a document that the parties make to record all previous agreements and negotiations related to the transaction.

Step 8: Sign the contract

The parties sign the contract and each party is responsible for it. MERGER AND ACQUISITION ENTERPRISE

Step 9: Completing administrative procedures (licensing…) and Fulfilling financial obligations

Once the agreement is signed, investors.will receive a new share in the portfolio or expanded shares of the acquiring. the company, or sometimes the investor will receive a new class of stock, which identifies a new corporate entity that has just been created by the M&A.

In the event of a merger where one company acquires another, the acquiring. company will pay for the acquired company’s shares in stock, cash, or possibly both. MERGER AND ACQUISITION ENTERPRISE

The implementation process will be considered partially successful. when the parties modify the relevant licenses or receive approvals from the competent authorities. MERGER AND ACQUISITION ENTERPRISE

Step 10: Finish the M&A process

At the end of this process, the management team of. the acquiring company and the acquired company will work together on the merger of the two companies. The buyer will usually have to integrate.the acquired company as a subsidiary of the parent company or will have to ensure that the other subsidiary can operate independently as a normal business.

Currently, M&A activities occupy an important position in the market. Along with the outstanding benefits that M&A brings, businesses see this as a way to help promote their business activities. In particular, in the context of world economic integration, with huge capital sources from foreign investors, Vietnamese enterprises need to further promote M&A activities to promote their advantages and build and strengthen their position in the international arena.

The above are important regulations on merger and acquisition activities according to current regulations. To understand more about this activity, contact us directly via hotline +84 2862 779 399; +84 3939 30 522 or email info@lawplus.vn to get advice from the LawPlus team.